Article • 8 min read

Benchmark Snapshot: Tracking the impacts of COVID-19 on CX

By Ted Smith, Senior Director, Market Intelligence

Last updated May 26, 2021

ILLUSTRATION BY SOPHI GULLBRANTS

More than a year after the pandemic transformed the ways in which we live and do business, customer support teams continue to feel its impact. For many, changes once considered temporary have become the norm.

Teams continue to see record engagement from customers, even as they pivot to meet changing behaviors and expectations. Many agents still haven’t gone back to the office; some will likely not return. Though it’s been a year of unique and unprecedented change, support teams have met each challenge head on. They’ve adapted in ways they never thought possible, at a time when customer support has only become more important.

Looking ahead, we’re seeing trends that continue to shape what customer experience, and business as a whole, will look like in the near future. As our Benchmark team monitors the ongoing impact of the global health crisis on 90,000 companies that power their support operations using Zendesk, we’ll continue to offer insights and resources to help teams adapt.

- Watch our LinkedIn Live event to learn more about the trends we’re seeing and how businesses can respond with quick decisions on how to adjust their support channels.

UPDATED: April 26, 2021

Key takeaways

- Ticket spikes become new baselines

- Sectors heavily impacted by the pandemic have or will continue to bounce back

- What’s up? WhatsApp!

- Some industries are seeing tickets finally stabilize, while others continue to shoot up

- Hardest-hit sectors are successfully using help centers and workflow tools to deflect ticket volume

- Companies are actually responding faster than they did pre-pandemic

- Helpful resources

Ticket spikes become new baselines

It’s been a busy year, with no relief in sight for support agents, who are currently managing 30 percent more tickets than they did last year. Despite the volatility of the last several months, higher ticket volumes look like they’ll be here to stay: on average, tickets remain at a 20 percent higher baseline than before the pandemic.

Not all regions have seen equal impact, though; companies in Latin America (+41 percent) and North America (+36 percent) are currently seeing some of the highest increases. And by country, teams are feeling the most pressure in Japan (+201 percent), Australia (+46 percent), and Brazil (+41 percent).

It’s a similar story when considering total pandemic impact or how ticket volumes have changed, on average, during the entire length of the pandemic. Though it’s been a taxing year for all, it turns out that support teams in Brazil (+39 percent), Canada (+30 percent), and Australia (+20 percent) have seen the highest rates of sustained ticket growth over this past year.

Sectors heavily impacted by the pandemic have or will continue to bounce back

Ridesharing

The ridesharing industry came to a screeching halt in early 2020, but as restrictions ease, customers are coming back. Ridesharing tickets freefell last March, but have since made a full recovery. In 2021, ticket volume soared to even higher levels than were seen pre-pandemic.

Travel and hospitality

Meanwhile, a recent uptick in ticket volume in the hard-hit travel and hospitality industry hints at a revival after travel abruptly stopped one year ago. Thanks to new CDC guidelines on travel for vaccinated individuals, experts seem to think that a slow return to normal travel and tourism rates is beginning, if the TSA’s passenger volume counts are anything to go by.

What’s up? WhatsApp

During a year in which change was the only constant, customers found comfort in the familiar, turning to messaging services like Facebook Messenger and WhatsApp to communicate with businesses.

74 percent of customers who messaged with companies in 2020 plan to keep doing so

Messaging has taken off during the last year, with 64 percent of customers reporting that they tried a new channel in 2020. That doesn’t mean messaging will only last as long as the pandemic, though: 74 percent of customers who messaged with companies in 2020 plan to keep doing so.

WhatsApp usage continues to soar (up an average of 219 percent globally, and a whopping 327 percent in Latin America!), particularly with ecommerce companies. But social messaging usage isn’t spiking across the board: Facebook Messenger and Twitter usage actually dropped 20 percent in the US.

When it comes to other channels, customers buying their groceries online, gaming, or booking trips are relying on live chat more so than before the pandemic, while rates have fallen for those reaching out to fitness and entertainment industries. Phone usage is up for customers reaching out to ride sharing, food delivery, and online health companies, and down for those booking travel or shopping online.

Some industries are seeing tickets finally stabilize, while others continue to shoot up

Remote work and learning

Now that people are more comfortable navigating remote classrooms and work meetings, tickets are finally stabilizing (though at a higher baseline) for remote work and learning companies. Tickets for these companies, which soared after stay-at-home orders became the new norm, stayed high for the vast duration of the pandemic.

Food delivery and grocery

Interestingly, food delivery (+29 percent) and grocery tickets (+114 percent) are currently inching up to some of the highest peaks seen since the pandemic began. Tickets surged last April as shelter-in-place orders kept customers at home, but this new uptick suggests that these services may have long-term staying power, even as life returns to normal.

Social media

Social distancing may have been the norm, but that hasn’t stopped engagement with social media companies. Ticket volumes have maintained a steady climb since last year, currently up a whopping 181 percent.This is no surprise– even when travel and personal interaction are restricted, the internet can take you anywhere (or at least teach you the latest TikTok dance).

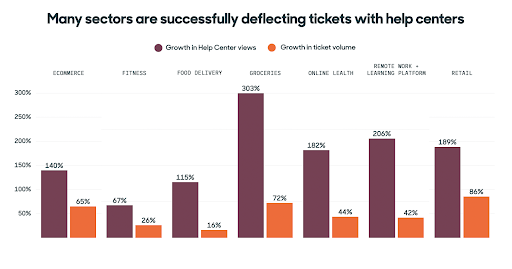

Hardest-hit sectors are successfully using help centers and workflow tools to deflect ticket volume

Companies of all sizes have had to manage higher-than-normal ticket volumes. Growth rates were four times faster in 2020, compared to the previous year. One key way that they’re managing this influx? By deflecting tickets with their help centers.

Hard-hit industries have been especially successful at this, with help center views outpacing the growth in new tickets for shipping and logistics firms (help center views grew 12.5x faster than new tickets), hospitals (8.2x faster), and food delivery companies (7x faster).

Support teams that already rely on chatbots and other workflow management tools are using more of them in 2021. Overall, usage of macros, triggers, and other automations is up 25 percent since last year. These help teams get tickets to the right people, enable agents to make quick suggestions for customers, and automate email updates so teams can focus their efforts elsewhere.

Answer Bot resolutions are up 60 percent since the pandemic began

After an initial spike last April, usage of Answer Bot is also trending upwards once more, currently resolving 60 percent more issues than before the pandemic. This can be vital for teams dealing with high ticket influxes as chatbots can reduce customer wait times (and reduce the strain on their human counterparts) by answering common questions in real time.

Companies are actually responding faster than they did pre-pandemic

Despite runaway ticket growth, companies have largely held their own (and then some!). And this holds true for all companies, from the smallest teams to the largest support departments.

In fact, most sectors are also responding to customers faster than they did before the pandemic. How? Companies have streamlined workflows, enabled always-on support, and turned to channels that make it easier for agents to tackle multiple tickets at once.

Looking ahead, agility will be the key to providing top-notch service, no matter what comes next.

Helpful resources

The past year has created new challenges for companies and their customer experience teams, making it harder to keep up with what matters the most to their business—their customers and their team. Zendesk will continue to track the impacts of COVID-19 on companies around the globe and will publish insights and resources on this page.

“We are focused on helping people around the world adapt to remote work with free resources—and we’re also directly supporting organizations working on coronavirus research, response, or mitigation with free upgrades,” said Ali Rayl, VP of Customer Experience at Slack. “Now more than ever, it’s important that we continue working with partners like Zendesk on integrations that can help keep operations running smoothly.”

Check out some helpful resources below:

Solutions and programs:

COVID-19 articles and resources:

- 7 tips to get your support teams through 2020 (and beyond!): Whether you’re in the middle of a ticket surge, a lull, or somewhere in between, now is the time to implement best practices that will help your company be ready for the uncertainties that lie ahead.

- Home-bound customers turn to messaging channels: What does the growing popularity of channels like WhatsApp and Facebook Messenger say about changing customer expectations?

- SMBs can do more with less during times of change: Small and large companies have seen similar volatility when it comes to support requests. But with far fewer resources, it’s much harder for smaller businesses to scale and meet customer demand. So how have they been weathering the crisis? And what lessons can teams learn to help them successfully navigate these challenges in the weeks and months ahead?

- How to navigate the lasting impacts of COVID-19 on customer support: As COVID-19 disrupts business as usual, we’re seeing monumental changes take place in a mere matter of months. Are these changes merely a response to the pressures created by a global crisis, or a sea change for customer support?

- 6 contact tracing best practices—and how technology can help: Improving the contact tracing experience helps students, citizens, and employees feel more connected and trusting of their school, local government, or workplace.